Personal Loans Canada Can Be Fun For Anyone

Wiki Article

6 Easy Facts About Personal Loans Canada Explained

Table of ContentsThe Basic Principles Of Personal Loans Canada What Does Personal Loans Canada Do?The Greatest Guide To Personal Loans CanadaEverything about Personal Loans CanadaSee This Report about Personal Loans Canada

Settlement terms at the majority of personal loan lending institutions vary in between one and seven years. You obtain all of the funds simultaneously and can use them for nearly any objective. Customers often use them to fund a possession, such as a lorry or a boat, settle financial debt or assistance cover the expense of a significant expenditure, like a wedding celebration or a home improvement.:max_bytes(150000):strip_icc()/whatsapersonalloan-49a4338af74741e7b4dbb0884a191283.jpg)

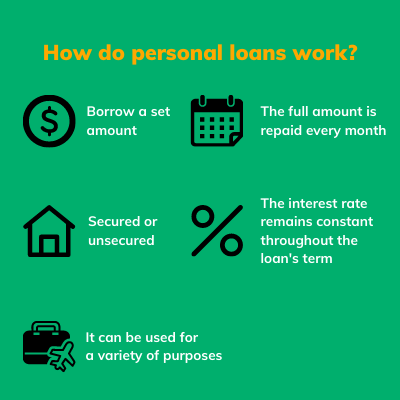

Individual finances included a taken care of principal and rate of interest monthly settlement for the life of the financing, computed by accumulating the principal and the interest. A fixed price gives you the safety and security of a predictable regular monthly payment, making it a prominent option for combining variable rate bank card. Repayment timelines differ for individual car loans, yet consumers are typically able to select repayment terms in between one and seven years.

Personal Loans Canada for Dummies

The fee is generally subtracted from your funds when you complete your application, decreasing the quantity of cash money you pocket. Individual loans rates are more straight linked to brief term prices like the prime rate.You may be supplied a reduced APR for a much shorter term, due to the fact that loan providers understand your balance will be repaid faster. They might charge a greater price for longer terms knowing the longer you have a lending, the more probable something might alter in your funds that could make the settlement unaffordable.

A personal loan is also a great choice to making use of credit report cards, since you borrow money at a set price with a precise payoff date based upon the term you choose. Remember: When the honeymoon mores than, the month-to-month payments will be a pointer of the money you invested.

7 Simple Techniques For Personal Loans Canada

Compare passion prices, fees and lending institution reputation before using for the funding. Your credit report rating is a huge variable in identifying your eligibility for the car loan as well as the interest rate.Prior to using, understand what your score is to make sure that you know what to expect in regards to expenses. Be on the search for hidden charges and fines by reading the loan provider's conditions web page so you do not finish up with less cash than you need for your financial goals.

They're much easier to certify for than home equity lendings or other safe financings, you still require to show the lending institution you have the ways to pay the car loan back. her comment is here Personal loans are far better than credit scores cards if you desire an established monthly repayment and need all of your funds at as soon as.

9 Simple Techniques For Personal Loans Canada

Charge card might be much better if you need the versatility to draw cash as needed, pay it off and re-use it. Credit scores cards may likewise use rewards or cash-back choices that individual finances don't. Ultimately, the ideal debt item for you will depend on your cash behaviors and what you require the funds for.Some lenders may also charge fees for personal fundings. Individual financings are lendings that can cover a number of personal costs. You can locate personal fundings through banks, lending institution, and online lenders. Personal financings can be safeguarded, suggesting you require collateral to borrow cash, or unsecured, without any collateral required.

As you invest, your readily available credit report is lowered. You can then increase offered credit score by making a settlement toward your credit scores line. With an individual finance, there's typically a fixed end date whereby the lending will be repaid. An individual line of credit history, on the other hand, Look At This might continue to be open and available to you indefinitely as long as your account stays in great standing with your lender - Personal Loans Canada.

The cash obtained on the lending is not tired. If the lending institution forgives the financing, it is considered a terminated financial obligation, and that quantity can be tired. Individual finances may be secured or unsafe. A secured personal financing requires some kind of security as a problem of loaning. For circumstances, you might safeguard an individual car loan with money properties, such as an interest-bearing account or certification of down payment (CD), or with a physical asset, such as your cars and truck or watercraft.

The Definitive Guide to Personal Loans Canada

An unsafe personal funding calls for no collateral to obtain cash. Banks, credit history unions, and online lenders can use both safeguarded and check unsecured personal financings to qualified debtors.

Once more, this can be a financial institution, credit union, or on-line personal finance lending institution. If accepted, you'll be offered the financing terms, which you can approve or deny.

Report this wiki page